Defender Credit Fund

The investment objective of the Fund is to generate steady returns for Unit Holders by investing in a diverse portfolio of quality SME and middle market corporate Loans typically secured against residential or commercial property.

About Fund

The Fund has been established to take advantage of the gap in Australia’s business Loan market, and area under-serviced by the Big Four banks, in which the Manager believes there are strong risk adjusted return opportunities available in Australia’s alternate Loan market. The Fund’s investment strategy focuses on investing only in Loans to SME and mid-market companies with appropriate collateral pools. Using this approach, we allocate:

- Up to 100% of our portfolio to diversified senior

secured Loans. - From 10% – 15% of our portfolio to special situation, subordinated or unsecured short dated senior Loans

unit class

unit class

unit class

About the Fund Manager

The Manager is a specialist alternative investment manager and brings a strong record of accomplishment. Its two founds have over 20 years of combined investment experience across a broad range of financial markets including corporate finance, funds management, property development and non-bank lending sector. As a firm majority owned by its principals, our client’s objectives are our objectives. The Manager’s investment products are designed to take advantage of the strengths and capabilities of our experienced investment team and also the opportunities which we believe exist in the SME and mid-market debt sector.

James Manning

Director and Responsible Manager

Leads the compliance and management efforts at Defender AM. With a strong foundation in finance and accounting, James holds qualifications in B.Bus (Accounting) and M.Bus (Finance). Additionally, he holds leadership positions in Vertua Limited and Mawson Infrastructure, demonstrating his multifaceted experience and capabilities.

Nick Hughes Jones

Director and Responsible Manager

Nick directs the investment management strategy for Defender Capital’s main funds and leads the formulation and execution of the investment process. With 12 years of experience, he previously managed over $500 million for family offices and high-net-worth individuals at Bell Potter Securities and Southern Cross Equities, prestigious firms in Australia.

How we construct our Loan Portfolio

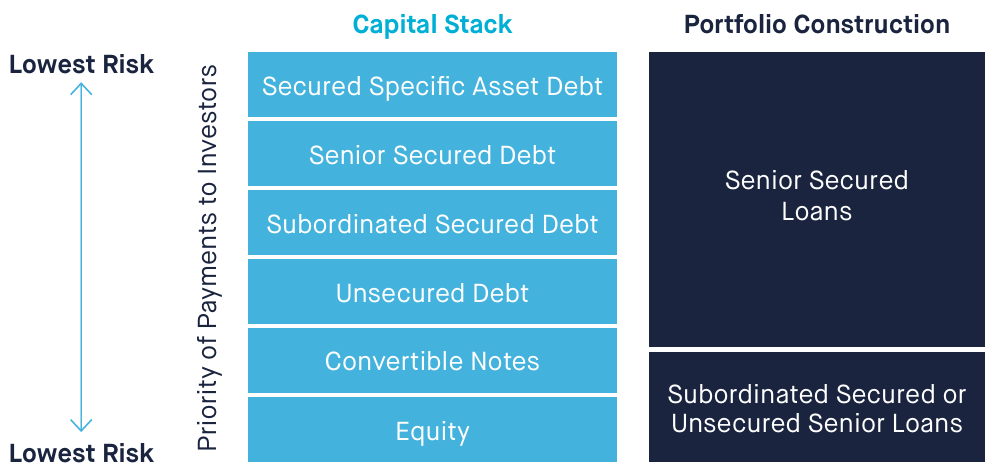

DCF’s investment strategy focuses on investing only in loans to SME and mid market companies with appropriate collateral pools. Using this approach, we allocate:

• Up to 100% of our portfolio to diversified senior secured loans.

• From 0% – 15% of our portfolio to special situation, subordinated or unsecured short dated senior loans.

Fund Classes

CLASS

RATE

LOCK UP

MINIMUM INVESTMENT

STATUS

Supplementary Information Memorandum

RATE

15%

LOCK UP

14 Months

MINIMUM INVESTMENT

$ 25,000

STATUS

Open

Supplementary Information Memorandum

RATE

14%

LOCK UP

14 Months

MINIMUM INVESTMENT

$ 25,000

STATUS

Open

Supplementary Information Memorandum

RATE

12%

LOCK UP

7 Months

MINIMUM INVESTMENT

$ 25,000

STATUS

Open

Supplementary Information Memorandum

Latest News

- Defender Credit, Investment insights

- Defender Capital Pty Ltd

- Published

- Defender Credit, Investment insights

- Defender Capital Pty Ltd

- Published

- Defender Credit, Investment insights

- Defender Capital Pty Ltd

- Published

- Defender Credit, Investment insights

- Defender Capital Pty Ltd

- Published

- Defender Credit

- Defender Capital Pty Ltd

- Published

- Defender Credit

- Defender Capital Pty Ltd

- Published

- Defender Credit

- Defender Capital Pty Ltd

- Published

- Defender Credit

- Defender Capital Pty Ltd

- Published

- Defender Credit

- Defender Capital Pty Ltd

- Published

Put Yourself in the Right Lane For Success.

Contact one of our Financial Professionals Today.