Investment objective

The investment objective is to generate superior returns for Unit holders by investing in global markets, with a focus on reducing risk and preserving capital.

More information can be found in the Information Memorandum located at the Fund website.

Applications available here.

Investment Strategy

The Defender Global Fund (Fund) provides investors with exposure to global markets through a long and short strategy

The Fund starts with the Managers global macroeconomic and market outlook, then overlays key thematics which the Manager believes will effect future performance and combines this with a bottom-up investment decision criteria.

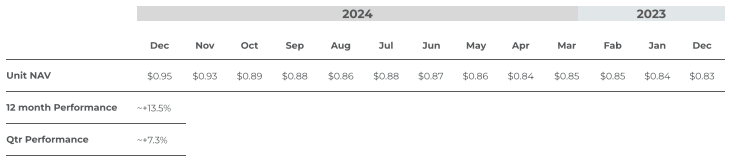

Performance Summary

Commentary

The Defender Global Fund returned +7.3% in Q4 CY2024.

Macroeconomic conditions in the US in Q4 departed from the 2024 trend, with recently falling inflation showing signs of moderation, causing US 10yr bond yields to rise significantly over the period – the US 10yr moved from 3.8% to 4.6%, settling at ~4.8% at time of writing. Unemployment remained around the 4.1% mark in December, with The Atlanta Fed forecasting US Q4 GDP

at 2.7%.

As we mentioned in our Q3CY24 newsletter, the Federal Reserve cut interests rates by (a surprising) 50bp at their September meeting, ahead of the US election where President Trump was confirmed as the 47th President of the United States. The Fed then cut interest rates by a further 50bp at subsequent meetings, for a cumulative 100bps in 2024.

Recent data on inflation and the economy, as well as the risk of material tariffs being implemented have resulted in a more cautious Federal Reserve – with minutes from

their most recent meeting suggesting that interest rate cuts in 2025 and 2026 may be less than previously forecast, the market is currently forecasting only two interest rate cuts in 2025.

Interestingly in Q4, the first pure play AI/HPC GPU as a Service company re listed on the Nasdaq Nebius Group (NBIS.NASDAQ). The re listing was hugely successful, with

the company running up over 80% from its re listing price of $22, to over $35 at time of writing and commanding a market capitalisation of over $7.5BN.

Nebius is an AI infrastructure business, providing GPU compute as a service as well as other offerings including autonomous driving technology, an edtech platform and a Gen AI developer offering.

As written previously, The Defender Global Fund has a position in Sharon AI Inc, a a High Performance Computing company focused on Artificial Intelligence, Cloud GPU Compute Infrastructure & Data Storage. Sharon AI has a hybrid operational model that sees it deploy in Tier III & Tier IV co location data centers as well as design, build and operate its own proprietary specialized data centre facilities. We are encouraged by the public market reception of the Nebius Group relisting and look forward to updates from the Sharon AI team in due course.

In recent years the equity market has struggled to hold gains when the US 10yr yield approaches 5%, so we are watching this development closely and have raised cash levels accordingly.

During the quarter we continued to be opportunistic across our core themes (Technology, AI, Special Situations), with activity in Amazon (AMZN.NASDAQ),

Google (GOOG.NASDAQ), NVIDIA (NVDA.NASDAQ) as well as additional investment into our alternatives assets bucket via Court House Capital (CHC) III (unlisted litigation fund).

Artificial Intelligence (AI) – Google, Amazon, NVIDIA & Nebius Group

As we have written on regularly, we have a very positive view on Artificial Intelligence and the beneficiaries of this megatrend over the short and medium term.

During the quarter we took profits on Google, NVIDIA and Amazon, feeling valuations had run very quickly in a short period of time, we will be monitoring Q4 earnings calls in January for a potential re-entry into Google, NVIDIA and Amazon.

Special Situations Court House Capital (CHC) III

Over the course of the quarter we added to our investment in CHC III, which provides a capital guarantee plus expected 20%pa return, with a two year term. CHC III

has continued recent strong performance and provided an update for the quarter.

CHC III is now full and will not take on any more cases, the fund has 11 litigation projects with a total claim size totalling $578M, with solid progress made on high profile

cases involving A2 Milk, The Australian Grand Prix, Toyota NZ and Westpac.

We like this alternative investment as it is not correlated to equity markets, provides a capital guarantee and a very attractive expected 20%pa return over 2 years.

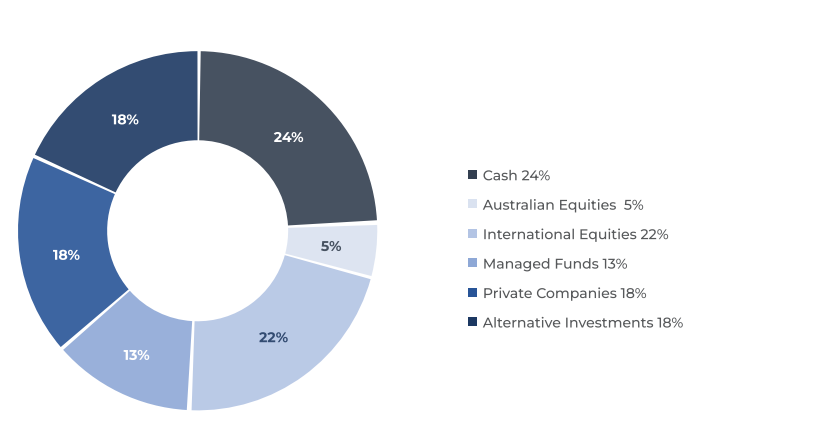

The Defender Global Fund is currently running higher than normal cash levels (~24%), an appropriate setting in our minds given the macroeconomic backdrop, and as we enter critical earnings reporting periods for the US in January and in Australia in February.

As always we are available to a more granular discussion at any time.

Key Information

Strategy Inception

January 2025

Portfolio Managers

James Manning, Nick Hughes Jones

Net Asset Value

$ 0.95 AUD (Dec 31)

Liquidity

Monthly

Management Fee

1% p.a.

Performance Fee

20%

(subject to high water mark)

Sector allocation

January 2025

Important Notice

This report has been prepared by Defender Capital Pty Ltd ABN 58 636 314 540, operating under a Corporate Authorised Representative agreement of Defender Asset Management Limited (AFSL 482722) (CAR 001 285 563), Fund Manager of the Defender Global Fund (ABN 27 482 997 023) without taking into account the objectives, financial situation or needs of individuals and is prepared only for wholesale investors. Before making an investment decision about the Fund, investors should read the Fund’s Information Memorandum available at the Funds website https://defenderam.com/investments/ or by contacting [email protected] and obtain advice from an appropriate financial adviser. Units in the Fund

are issued by Defender Asset Management Limited (ABN 29 608 281 189) (AFSL 482722). This information is current as at the date of publication. The material has been prepared based on information believed to be accurate at the time of publication. Assumptions and estimates may have been made which may prove not to be accurate. Defender Capital undertakes no responsibility to correct any such inaccuracy. Subsequent changes in circumstances may occur at any time and may impact the accuracy of the information. To the full extent permitted by law, neither the Fund Manager, the trustee or any related entities makes any warranty as to the accuracy or completeness of the information in this newsletter and disclaims all liability that may arise due to any information contained in this newsletter being inaccurate, unreliable, or incomplete. Past performance is not a reliable indicator of future performance.