Investment objective

The investment objective is to generate superior returns for Unit holders by investing in global markets, with a focus on reducing risk and preserving capital.

More information can be found in the Information Memorandum located at the Fund website.

Applications available here.

Investment Strategy

The Defender Global Fund (Fund) provides investors with exposure to global markets through a long and short strategy.

The Fund starts with the Managers global macroeconomic and market outlook, then overlays key thematics which the Manager believes will effect future performance and combines this with a bottom-up investment decision criteria.

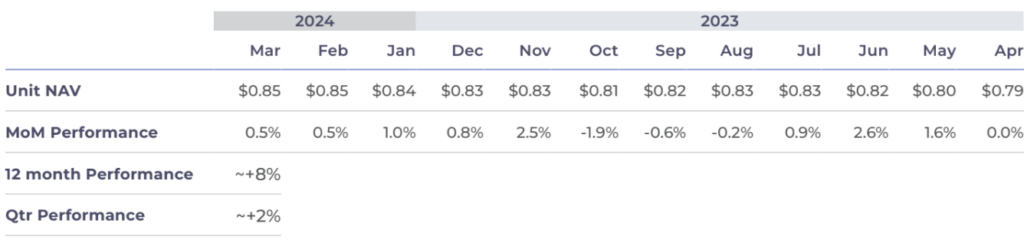

Performance Summary

Commentary

The Defender Global Fund returned +2% in Q1 CY2024.

The Fund’s managers typically start with an assessment of global macro conditions, then move on to the company-specific or micro conditions as part of our investment and portfolio allocation process. At present, macroeconomic conditions appear to be shifting into a new phase – in Q1, we saw continued stabilisation of inflation in the developed world, relatively quiescent monetary conditions (US 10yr bond yields rising from 3.9% to 4.3% over the quarter and most central banks with interest rates on hold), continued loose fiscal policy (especially in the US, ahead of a general election later in 2024), mixed economic data and positive equity markets overall. Amongst these signals there are nascent signs of a cyclical recovery underway, meaning “higher for longer” may be here to stay. In Q1 we continued to opportunistically invest across our core themes (Technology, De-Carbonisation, Artificial Intelligence, Special Situations), with activity in rare earths developer Meteoric Resources (MEI.ASX), Van Eck Semiconductor ETF (SMH.NASDAQ), Propel Funeral Partners (PFP.ASX), Northern Star Resources (NST.ASX) and Resolute Mining (RSG.ASX). We also had a positive update from one of our earliest private investments – Lyka Pet Food.

Private Investments – Lyka Pet Food

Lyka Pet Food is a tech-driven, Australian pet food manufacturer operating through eCommerce direct to consumers, offering fresh, sustainable, and human-grade meals for pets based on veterinary and nutrition advice. Lyka has seen rapid uptake of its products, with revenue and active dogs growing extremely fast as a result. We met with Lyka Pet Food management in mid 2021 and made an investment into their Series A round shortly thereafter. The Fund is up over 300% on this investment

in just over 2.5 years, and we believe the business still has significant runway ahead of it. This is a testament to the drive and vision of the company’s founders Anna Podolsky, Dr Matthew Muir and Gabriel Guedes. In recent years there has been a surge in pet ownership, with 69% of households now embracing a furry family member, as reported by leading veterinary association, Animal Medicines Australia. To take advantage of this growth, Lyka has invested heavily in the local Victorian economy, building a reported $16M pet food manufacturing facility and national distribution centre in Dandenong South. This new facility includes new production lines and advanced, automated equipment that will enable the business to increase scale and drive margin efficiencies. We believe this facility and other business initiatives will drive impressive growth for years to come for Lyka.

Artificial Intelligence (Ai) – Van Eck Semiconductor ETF (SMH.NASDAQ)

We believe the Ai megatrend will be both long term and cyclical, and the Fund continues to be well leveraged to this via direct and indirect holdings, with the two largest listed positions being Microsoft and Alphabet (Google). The transformative power of Ai is undeniable and the impact it will have on society over the coming years will be significant. Measurement of this impact will be both short term and generational. As a result, we have been considering how to best invest in the sector and how to gain exposure to the thematic over the long term, as well as considering shorter term trading strategies. On this front, the Fund initiated a tactical position in SMH.NASDAQ in early Q1 CY2024 and exited this position in late Q1 CY2024 for a +17% return. The Van Eck Semiconductor ETF (SMH.NASDAQ) is an exchange-traded fund that provides exposure to semiconductor production and equipment, with the largest holdings in the ETF including Nvidia Corp (20%), Taiwan Semiconductor Manufacturing Co (12%), Broadcom Inc (7.5%), Asml Holdings (5%), Texas Instruments Inc (4.5%), Qualcomm Inc (4.5%), Intel Corp (4.5%), Lam Research Corp (4.5%), Micron Technology Inc (4.5%), Applied Materials Inc (4.5%) and Advanced Micro Devices Inc (3.5%). We take a basket or ETF approach to this specific thematic within the overall Ai megatrend given the large observed historical volatility/high cyclicality of semiconductor companies. This approach allows us to capture the overall upside and avoid some of the inevitable poor performers. Several markers over the course of the quarter led us to believe that the sector had become overextended, at least on a short-term basis, and hence we exited the position sooner than anticipated. We will continue to monitor the semiconductor sector, andin particular this ETF (as we like the constituent make-up of the ETF with a heavy weighting to Nvidia and TSMC) for a re-entry at a more appropriate time and level. We continue to have meaningful exposure to other Ai beneficiaries (Nvidia, Apple, Amazon, AMD, Meta (Facebook) and Tesla) via our currency hedged Nasdaq (+8.3% in Q1) and S&P500 positions (+10% in Q1). As always, we are available for a more granular conversation at any time.

Key Information

Strategy Inception

January 2023

Portfolio Managers

James Manning, Nick Hughes Jones

Net Asset Value

$0.8493 AUD (December 31)

Liquidity

Monthly

Management Fee

1% p.a.

Performance Fee

20%

(subject to high water mark)

Sector allocation

As at 12 April 2024

Important Notice

This report has been prepared by Defender Capital Pty Ltd ABN 58 636 314 540, operating under a Corporate Authorised Representative agreement of Defender Asset Management Limited (AFSL 482722) (CAR 001 285 563), Fund Manager of the Defender Global Fund (ABN 27 482 997 023) without taking into account the objectives, financial situation or needs of individuals and is prepared only for wholesale investors. Before making an investment decision about the Fund, investors should read the Fund’s Information Memorandum available at the Funds website https://www.defenderam.com/investments/ or by contacting [email protected] and obtain advice from an appropriate financial adviser. Units in the Fund are issued by Defender Asset Management Limited (ABN 29 608 281 189) (AFSL 482722). This information is current as at the date of publication. The material has been prepared based on information believed to be accurate at the time of publication. Assumptions and estimates may have been made which may prove not to be accurate. Defender Capital undertakes no responsibility to correct any such inaccuracy. Subsequent changes in circumstances may occur at any time and may impact the accuracy of the information. To the full extent permitted by law, neither the Fund Manager, the trustee or any related entities makes any warranty as to the accuracy or completeness of the information in this newsletter and disclaims all liability that may arise due to any information contained in this newsletter being inaccurate, unreliable, or incomplete. Past performance is not a reliable indicator of future performance.