Investment objective

The investment objective of the Fund is to generate steady returns for Unit Holders by investing in a diverse portfolio of quality SME and middle market corporate Loans typically secured against residential or commercial property.

More information can be found at the Defender AM Credit Fund web page.

Commentary

The Defender Credit Fund (“DCF”) continued to deploy capital and diversify our lending book in Q1, advancing loans into our target markets, being the SME and midmarket corporate loan sector. We continue to see strong demand for our offering, given the high interest rate environment, retreating major banks and inflationary pressures on households – all features that make servicing debts or obtaining new debts increasingly difficult. This macro backdrop has enabled the DCF to continue to deploy capital at attractive returns in the first quarter of CY2024.

New loans in the quarter were diversified by size, type and term, with security continuing to be strong with the vast majority of loans being 1st or 2nd mortgage secured by one or more residential properties in Australia.

One of our strengths is the ability to document with speed and efficiency, and this is a key attraction for our customers. For example, one of our new lends for the quarter was originated and documented inside two weeks. This enabled the DCF to secure attractive terms for a short term loan. This particular loan had the following attributes:

Loan size – ~$460,000

Security – 2nd mortgage across 4 properties

Term – 2 months

Return – 2.2% per month + fees

The traditional banking system typically struggles to document loans and respond to customers’ needs in the timeframe required. This provides opportunities for the DCF and creates repeat business because we are a trusted, and expedient institution to work with.

Investment Strategy

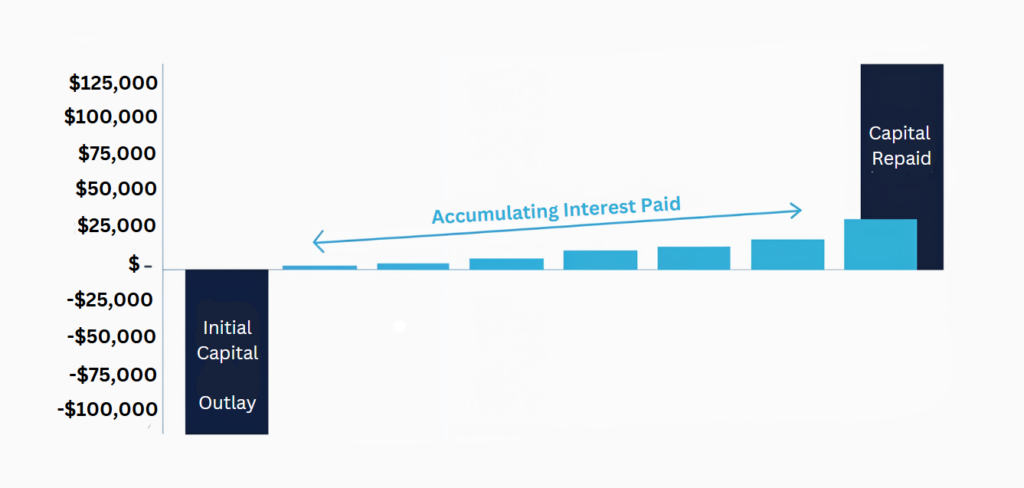

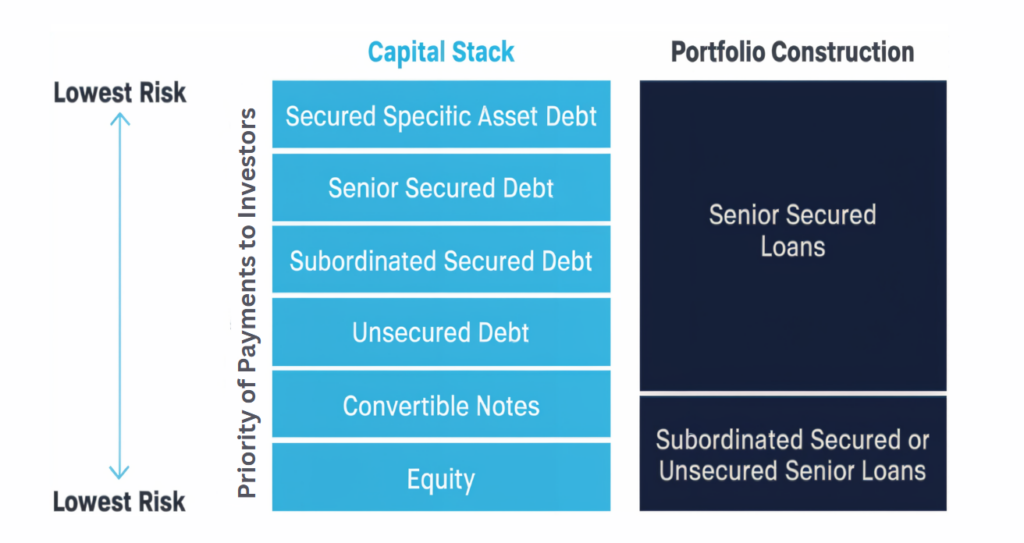

The Fund has been established to take advantage of the gap in Australia’s Loan market, an area under-serviced by the Big Four banks, in which the Manager believes there are strong risk adjusted return opportunities available in Australia’s alternate Loan market. The Fund’s investment strategy focuses on investing only in Loans to SME and mid-market companies with appropriate collateral pools. Using this approach, we allocate:

- Up to 100% of our portfolio to diversified senior secured Loans.

- From 0% – 15% of our portfolio to special situation, subordinated or unsecured short dated senior Loans

Current Portfolio Information

How we construct our loan portfolio

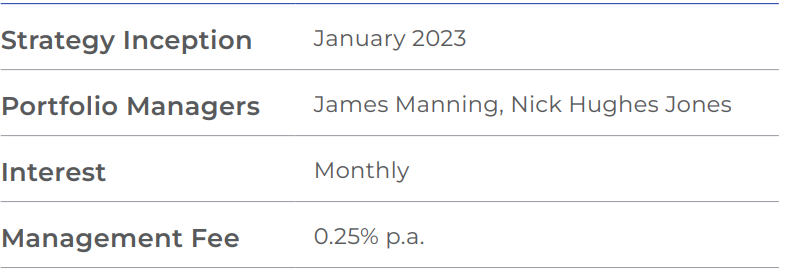

Key information

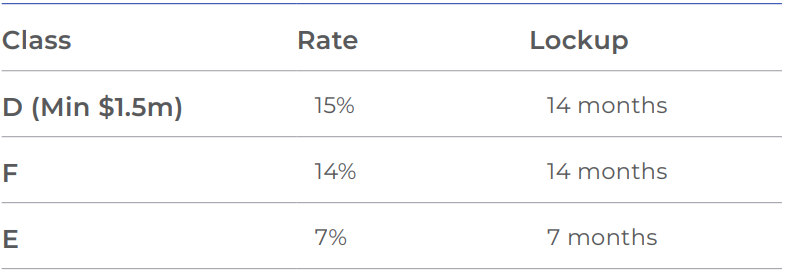

Current classes available

Overview of investment opportunity