Investment objective

The investment objective of the Fund is to generate steady returns for Unit Holders by investing in a diverse portfolio of quality SME and middle market corporate Loans typically secured against residential or commercial property.

More information can be found at the Fund website.

Commentary

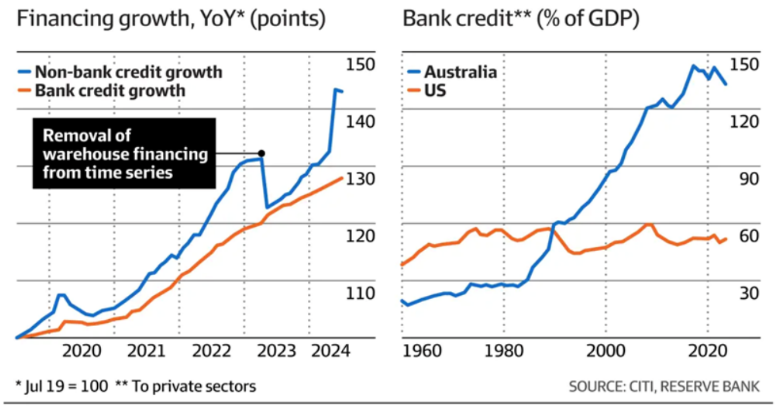

The Defender Credit Fund (“DCF”) loan book continued to perform well over the quarter. Our stringent lending criteria, careful consideration of valuations and security plus overall risk management framework ensures that only the highest quality prospects make it to the credit committee for approval. The demand for our offering remains high and we continue to receive and assess new loans on a weekly basis. The Private Credit industry attracted headlines in Q2, with major Australian and global media outlets reporting on a sector that was seeing rapid growth, primarily as a result of traditional banks losing market share due to tighter lending standards and regulation, excessive red tape and increased processing times for loan documentation. A link to an Australian Financial Review and Wall Street Journal article.

These tailwinds see the Defender Credit Fund (“DCF”) well- placed as we enter Q3 and beyond.

During the quarter we were provided with the opportunity for repeat business with a previous borrower, as a result of a good working relationship historically. This type of lending activity is welcomed, as typically we will have good information on their borrowing history and underlying security. This particular loan had the following attributes:

Loan size – $480,000

Security – 2nd mortgage across 1 property in NSW

Term – 3 months

Return – 1.75% per month + fees

The DCF team attended the Australian Investment Council Private Debt Conference in April, which provided us with an opportunity to learn about current trends, mingle with industry service providers and meet with prospective investors and borrowers. One of the more interesting data points from this event was that Private Credit is one of the fastest growing sectors in financial services at present, a $185bn market predicted to grow to $300bn by the end of the decade.

Investment Strategy

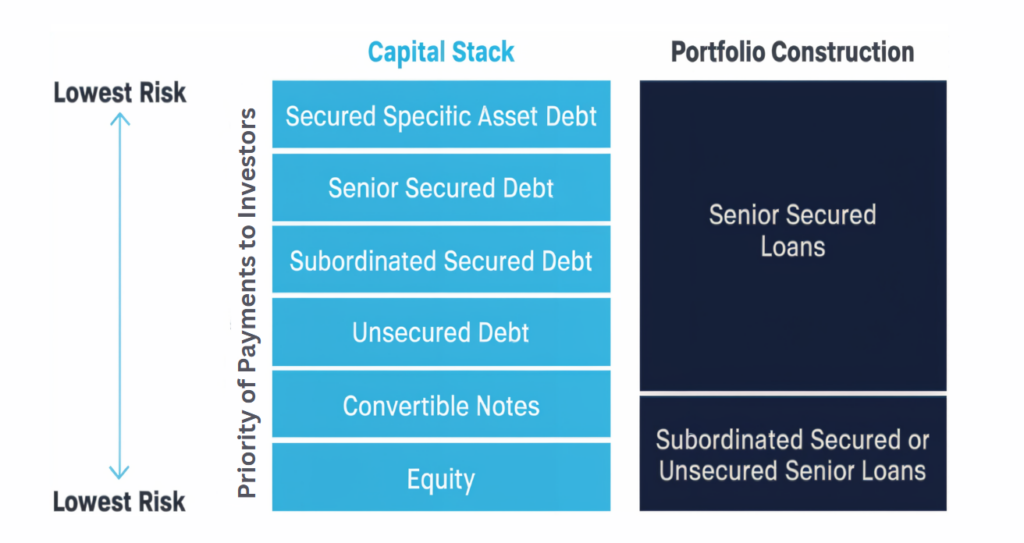

The Fund has been established to take advantage of the gap in Australia’s Loan market, an area under-serviced by the Big Four banks, in which the Manager believes there are strong risk adjusted return opportunities available in Australia’s alternate Loan market. The Fund’s investment strategy focuses on investing only in Loans to SME and mid-market companies with appropriate collateral pools. Using this approach, we allocate:

- Up to 100% of our portfolio to diversified senior secured Loans.

- From 0% – 15% of our portfolio to special situation, subordinated or unsecured short dated senior Loans

Current Portfolio Information

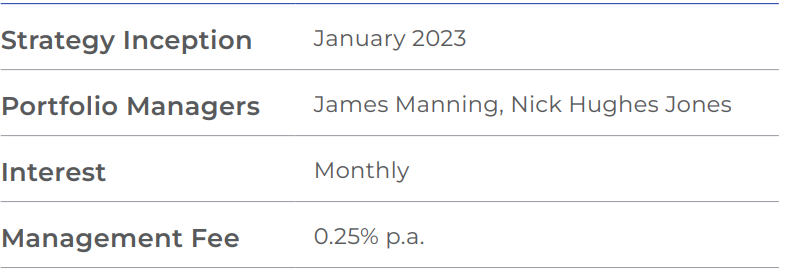

Key information

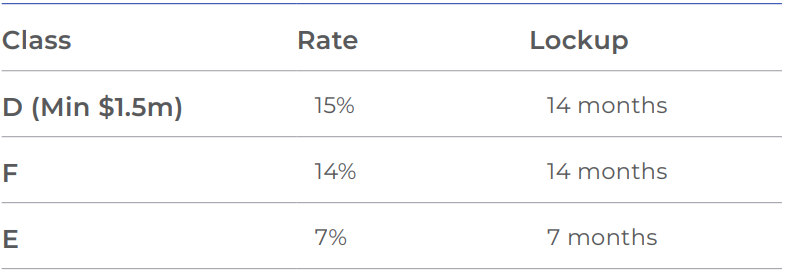

Current classes available

Important Notice

This report has been prepared by Defender Capital Pty Ltd ABN 58 636 314 540, operating under a Corporate Authorised Representative agreement of Defender Asset Management Limited (AFSL 482722) (CAR 001 285 563), Fund Manager of the Defender Global Fund (ABN 27 482 997 023) without taking into account the objectives, financial situation or needs of individuals and is prepared only for wholesale investors. Before making an investment decision about the Fund, investors should read the Fund’s Information Memorandum available at the Funds website https://defenderam.com/investments/ or by contacting [email protected] and obtain advice from an appropriate financial adviser. Units in the Fund are issued by Defender Asset Management Limited (ABN 29 608 281 189) (AFSL 482722). This information is current as at the date of publication. The material has been prepared based on information believed to be accurate at the time of publication. Assumptions and estimates may have been made which may prove not to be accurate. Defender Capital undertakes no responsibility to correct any such inaccuracy. Subsequent changes in circumstances may occur at any time and may impact the accuracy of the information. To the full extent permitted by law, neither the Fund Manager, the trustee or any related entities makes any warranty as to the accuracy or completeness of the information in this newsletter and disclaims all liability that may arise due to any information contained in this newsletter being inaccurate, unreliable, or incomplete. Past performance is not a reliable indicator of future performance.