Investment objective

The investment objective is to generate superior returns for Unit holders by investing in global markets, with a focus on reducing risk and preserving capital.

More information can be found in the Information Memorandum located at the Fund website.

Applications available here.

Investment Strategy

The Defender Global Fund (Fund) provides investors with exposure to global markets through a long and short strategy.

The Fund starts with the Managers global macroeconomic and market outlook, then overlays key thematics which the Manager believes will effect future performance and combines this with a bottom-up investment decision criteria.

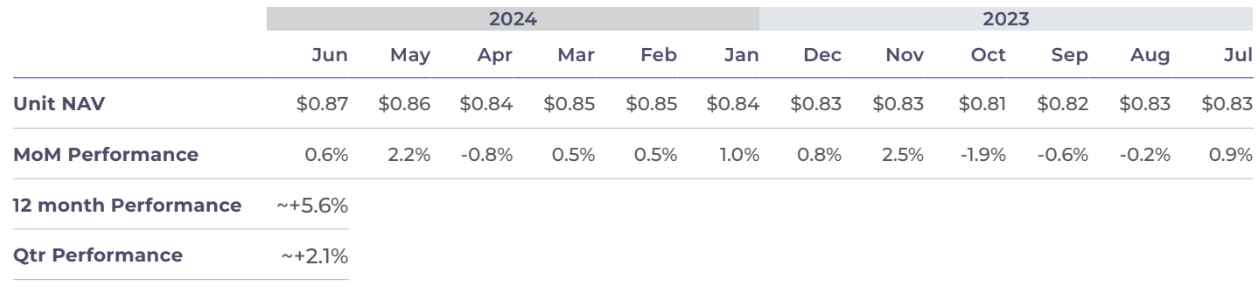

Performance Summary

Commentary

The Defender Global Fund returned +2.1% in Q1 CY2024.

The Fund has started positively in July, up +3%, driven by our investments in Artificial Intelligence (AI) beneficiaries Microsoft, Google, Amazon and the Van Eck Semiconductor ETF (SMH.NASDAQ). We further explore the AI thematic below, first we will touch on the macroeconomic settings, which informs our top-down and subsequent bottom-up approach to investment.

Macroeconomic conditions in the US in Q2 CY24 broadly saw a continuation of recent trends, with inflation continuing to cool, US 10yr bond yields maintaining a tight range between 4-4.5%, and unemployment ticking up mildly (at 4.1% post the June report).

This sets the scene for a potential cut in interest rates by the Federal Reserve at their September meeting (ahead of the US election in November), with market pricing 60bp of cuts before the end of 2024 as at time of writing. The much-anticipated loosening of financial conditions that appears to now be under way (ECB, BOC, SNB all reducing interest rates in Q2) should be a positive tailwind for current Fund positioning.

In Q2 we continued to opportunistically invest across our core themes (Technology, De-Carbonisation, AI, Special Situations), with activity in Pershing Square (PSH.L), battery metals developer Brazilian Rare Earths (BRE.ASX), Van Eck Semiconductor ETF (SMH.NASDAQ), Northern Star Resources (NST.ASX) and Betashares Global Uranium ETF. We also completed a successful partial sell- down of our most successful unlisted position to date, Lyka Pet Food.

Private Investments – Lyka Pet Food – Partial Sell-Down

Lyka Pet Food is a tech-driven, Australian pet food manufacturer operating through eCommerce direct to consumers, offering fresh, sustainable, and human-grade meals for pets based on veterinary and nutrition advice. Through hard work, excellent market positioning and by providing a genuinely good product at a reasonable price, the founders of Lyka, Anna Podolsky and Gabriel Guedes and their team have built a high-quality business that is seeing rapid revenue growth and increased

market share.

Lyka completed another capital raising and increase in valuation in Q2, providing investors with the opportunity to sell their existing holdings at the same time. The Fund took the opportunity to take out its cost base plus a healthy profit, whilst maintaining a meaningful position in Lyka. We are currently up 5x on our Lyka shareholding, having invested in mid 2021.

Artificial Intelligence (AI) – Van Eck Semiconductor ETF (Re-entry), Microsoft, Google, Currency Hedged Nasdaq ETF

We believe the generative AI revolution will be both long term and cyclical, and the Fund continues to be well leveraged to this via direct and indirect holdings, with the two largest listed positions being Microsoft and Alphabet (Google), two companies that have enormous leverage to this thematic given their large installed user base of billions of customers, and market leadership in AI.

The Van Eck Semiconductor ETF (SMH.NASDAQ) is an exchange traded fund that provides exposure to semiconductor production and equipment, with the largest holdings in the ETF including Nvidia Corp (20%), Taiwan Semiconductor Manufacturing Co (12%), Broadcom Inc (7.5%), Asml Holdings (5%), Texas Instruments Inc (4.5%), Qualcomm Inc (4.5%), Intel Corp (4.5%), Lam Research Corp (4.5%), Micron Technology Inc (4.5%), Applied Materials Inc (4.5%) and Advanced Micro Devices Inc (3.5%).

In Q1, the Fund entered and exited the Van Eck Semiconductor ETF (SMH.NASDAQ), as short term the major components of this index (Nvidia, TSMC, AMD) had become overextended, with the Fund exiting the position for a +17% return. In Q2, the Fund has re-entered and increased the size of the position as we are encouraged by a broadening of the AI thematic beyond market leader Nvidia (we are currently up +5% on this position).

For example, Broadcom recently reported revenue growth of +43% YoY, driven by its AI semiconductor segment , causing the company to upgrade guidance for CY2024 to $51bn, only halfway through the year.

TSMC now expects AI-related revenues to grow +50% this year as it benefits from AI-driven data centre and edge computing demand. “Edge AI” refers to AI applications on devices such as smartphones and personal computers, which is expected in due course to trigger replacement demand of high-end handsets (Apple), personal computers (Microsoft) and software (Google) as well as continued data centre growth (Amazon) to accommodate generative AI training and inference workloads.

We continue to have meaningful exposure to other AI beneficiaries (Nvidia, Apple, Amazon, AMD, Meta (Facebook) and Tesla) via our currency hedged Nasdaq (+8.3% in Q1) and S&P500 positions (+4.7% in Q1).

Special Situations – Betashares Global Uranium ETF

Data centre demand, driven by generative AI power requirements plus the shift to decarbonisation is driving a renaissance for nuclear energy globally. The number of nuclear reactors planned or under construction (which require large-scale amounts of uranium to power their operations) dwarfs the currently available supply of uranium across all time horizons. We believe we are still early in this thematic. We note with interest this year Amazon paid $640M for a 960MW nuclear campus in

Pennsylvania, eager to secure both power capacity/ infrastructure and underlying energy to power its data centres.

As a result, the Fund initiated a position in the Betashares Global Uranium ETF (URNM.AXW) during Q2, as the sector was in the midst of a sell-off triggered by a retracement in the spot price for uranium. This ETF is a portfolio of the largest uranium producers and developers, providing a diversified approach to this thematic. We are also assessing further direct holdings in this space and will report back on these in due course.

As always, we are available for a more granular conversation at any time.

Key Information

Strategy Inception

January 2023

Portfolio Managers

James Manning, Nick Hughes Jones

Net Asset Value

$0.8670 AUD (June 30)

Liquidity

Monthly

Management Fee

1% p.a.

Performance Fee

20%

(subject to high water mark)

Sector allocation

As at 17 July 2024

Important Notice

This report has been prepared by Defender Capital Pty Ltd ABN 58 636 314 540, operating under a Corporate Authorised Representative agreement of Defender Asset Management Limited (AFSL 482722) (CAR 001 285 563), Fund Manager of the Defender Global Fund (ABN 27 482 997 023) without taking into account the objectives, financial situation or needs of individuals and is prepared only for wholesale investors. Before making an investment decision about the Fund, investors should read the Fund’s Information Memorandum available at the Funds website https://www.defenderam.com/investments/ or by contacting [email protected] and obtain advice from an appropriate financial adviser. Units in the Fund are issued by Defender Asset Management Limited (ABN 29 608 281 189) (AFSL 482722). This information is current as at the date of publication. The material has been prepared based on information believed to be accurate at the time of publication. Assumptions and estimates may have been made which may prove not to be accurate. Defender Capital undertakes no responsibility to correct any such inaccuracy. Subsequent changes in circumstances may occur at any time and may impact the accuracy of the information. To the full extent permitted by law, neither the Fund Manager, the trustee or any related entities makes any warranty as to the accuracy or completeness of the information in this newsletter and disclaims all liability that may arise due to any information contained in this newsletter being inaccurate, unreliable, or incomplete. Past performance is not a reliable indicator of future performance.