Investment objective

The investment objective is to generate superior returns for Unit holders by investing in global markets, with a focus on reducing risk and preserving capital.

More information can be found in the Information Memorandum located at the Fund website.

Applications available here.

Investment Strategy

The Defender Global Fund (Fund) provides investors with exposure to global markets through a long and short strategy.

The Fund starts with the Managers global macroeconomic and market outlook, then overlays key thematics which the Manager believes will effect future performance and combines this with a bottom-up investment decision criteria.

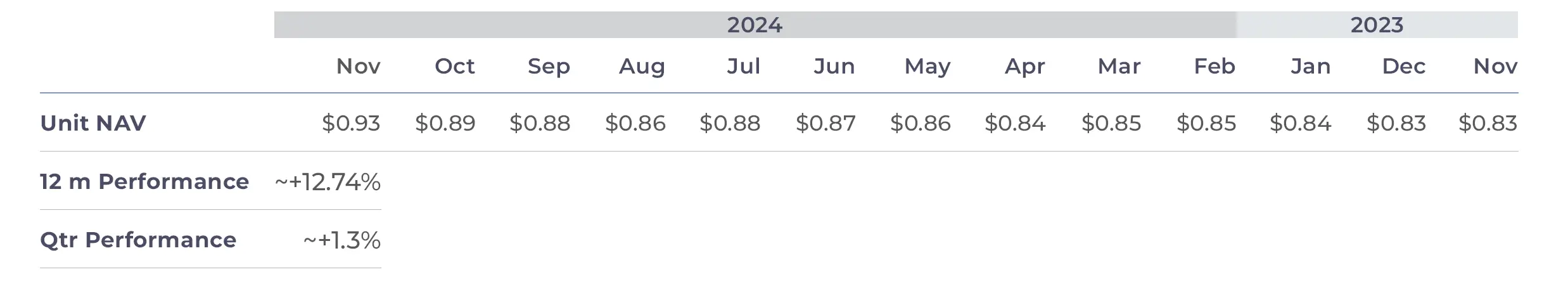

Performance Summary

Commentary

The Defender Global Fund returned +1.3% in Q3 CY2024.

The Fund has had a strong start to Q4, up over 4% quarter to date, driven by our investments in Artificial Intelligence (AI) beneficiaries Nvidia, Google, Sharon AI and Amazon.

Macroeconomic conditions in the US in Q3 CY24 saw inflation continuing to fall – with signs of this fall moderating due to sticky services inflation – the US 10yr bond yield moved from 4.4% to 3.8%, unemployment remained around the 4.2% mark and GDP rose 2.8% in Q3 – all signs of an economy growing, albeit moderately.

The Federal Reserve cut interests rates by 50bp at their September meeting, ahead of the US election where President Trump was confirmed as the 47th President of the United States, winning on a mandate to cut government waste, encourage growth via tax cuts and implement tariffs for trading partners in order to help Make America Great Again.

In Q3 we continued to opportunistically invest across our core themes (Technology, AI, Special Situations), with activity in Amazon (AMZN.NASDAQ), Nvidia (NVDA.NASDAQ), Van Eck Semiconductor ETF (SMH.NASDAQ), as well as taking advantage of special situations in Actinogen Medical (ACW.ASX), WA1 Resources (WA1.ASX) and BHP (BHP.ASX).

Special Situations – WA1 Resources, BHP, Actinogen Medical

Over the course of the quarter concerns over the Chinese property market and overall economic growth caused the has by far the biggest footprint, and had lagged the broader S&P500 allowing the Fund to establish a position during the quarter.

Total revenue for Amazon is expected to be ~$700BN in CY 2025, and the company has the largest Cloud business of the hyperscalers, with AWS revenue for Q3 CY2024 coming in at $27.45BN, up 19% and posting its 5th consecutive quarter of accelerating growth. This is now a >$100BN run rate business, and by far the most profitable, with AWS operating profit at $10.45BN in the quarter, over 60% of total operating profit.

Within the AWS division are some interesting trends – CEO Andy Jassy told analysts post the recent result that the artificial intelligence portion of AWS is now in the billions of dollars of annualized revenue, more than doubling year over year, which is extremely impressive given the small base only several years ago.

CEO of Amazon, Andy Jassy said “I believe we have more demand than we can fulfill even if we had more capacity today, I think pretty much everyone today has less capacity than they have demand for, and it’s really primarily chips that are the area where companies could use more supply.”

It is this thematic that keeps us bullish on the hyperscalers, and during the quarter the fund initiated a position in Amazon at ~$190.00,/share with Amazon trading at $213.00/share at time of writing.

The Fund also re-established a position in NVIDIA during the quarter at under $110.00/share, on the basis that upcoming earnings result in November would once again impress the analyst and investor community. Indeed, it did, with record quarterly revenue of $35.1BN, up 17% from Q2 and up 94% from a year ago. Similar to the detail in the Amazon result, Data Center revenue of $30.8BN, up 17% from Q2 and price of iron ore – and sentiment to those companies that exist on the steel value chain – to weaken materially. This caused diversified commodity producer BHP, and niobium explorer/developer WA1 Resources to fall substantially as a result. The Fund took advantage of these falls and established trading positions in both companies, both of which were exited at a profit.

Actinogen Medical Limited is an Australian biotech (led by CEO Dr Steven Gourlay) which has developed lead compound Xanamem, a unique brain-penetrant tissue cortisol synthesis inhibitor they hope will have materially positive impacts on the treatement of Major Depressive Disorder (MDD) and Alzheimer’s (AD). The Fund participated in a placement in Actinogen earlier in the year, for which it received free options. These options were exercised during the quarter and the stock subsequently sold for an approximate 2x profit.

Artificial Intelligence – Amazon, NVIDIA, Sharon AI

As we have written on regularly, The Fund has a very positive view on Artificial Intelligence and the beneficiaries of this megatrend over the medium term. Some of the larger individual positions in the portfolio continue to be Microsoft and Google, key AI beneficiaries given their very large economic moats, mature (and growing) Data Center/Cloud businesses and millions/billions of Monthly Active Users (MAU’s) across their various platforms (Microsoft Office, Microsoft Github, Google Search, Youtube, Maps, Gmail etc).

Out of the 3 largest Data Center/Cloud providers, Amazon up 112% from a year ago. The Fund subsequently sold the NVIDIA position in the low $140.00/share, we will look for an opportunistic time to re-enter.

CEO of NVIDIA, Jensen Huang said at the result “The age of AI is in full steam, propelling a global shift to NVIDIA computing. Demand for Hopper and anticipation for Blackwell – in full production – are incredible as foundation model makers scale pretraining, post-training and inference.

“AI is transforming every industry, company and country. Enterprises are adopting agentic AI to revolutionize workflows. Industrial robotics investments are surging with breakthroughs in physical AI. And countries have awakened to the importance of developing their national AI and infrastructure.”

We believe the generative AI revolution will be both long term and cyclical, and the Fund continues to be well leveraged to this via direct and indirect holdings, playing the thematic both by shorter term trading positions like NVIDIA and Amazon, and longer term positions like Google, Microsoft, Sharon AI and our hedged Nasdaq positions.

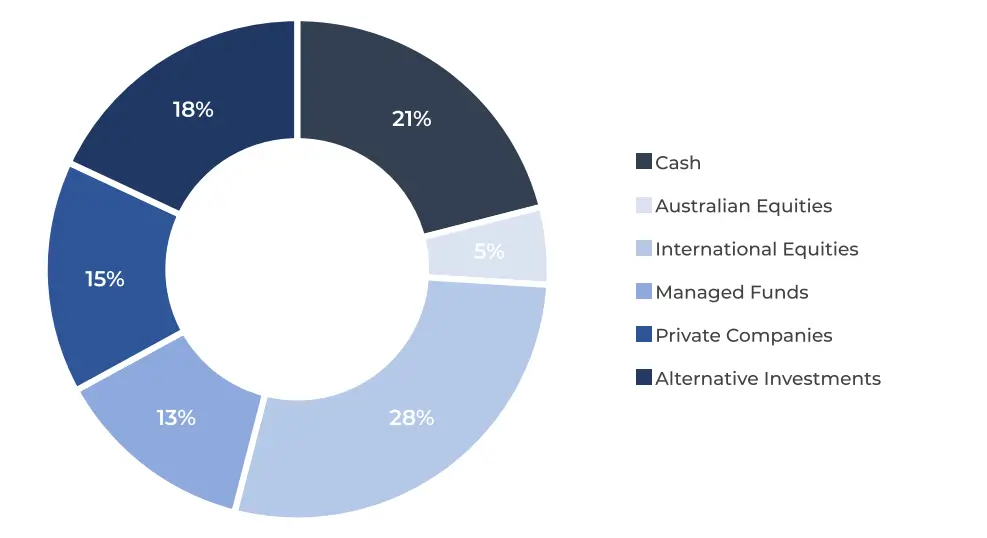

With the market moving higher post the US election, with multiples elevated and early signs of euphoria (crypto, memecoins, IPO and M&A activity all gathering steam) The Fund has taken a conservative approach and is currently running higher levels of cash, waiting for opportunities to present themselves.

As always we are available to a more granular discussion at any time.

The Defender Global Team

Key Information

Strategy Inception

January 2023

Portfolio Managers

James Manning, Nick Hughes Jones

Net Asset Value

$0.93 AUD (Nov 30)

Liquidity

Monthly

Management Fee

1% p.a.

Performance Fee

20%

(subject to high water mark)

Sector allocation

As at 4th December 2024

Important Notice

This report has been prepared by Defender Capital Pty Ltd ABN 58 636 314 540, operating under a Corporate Authorized Representative agreement of Defender Asset Management Limited (AFSL 482722) (CAR 001 285 563), Fund Manager of the Defender Global Fund (ABN 27 482 997 023) without taking into account the objectives, financial situation or needs of individuals and is prepared only for wholesale investors. Before making an investment decision about the Fund, investors should read the Fund’s Information Memorandum available at the Funds website https:// defenderam.com/investments/ or by contacting [email protected] and obtain advice from an appropriate financial adviser. Units in the Fund are issued by Defender Asset Management Limited (ABN 29 608 281 189) (AFSL 482722). This information is current as at the date of publication. The material has been prepared based on information believed to be accurate at the time of publication. Assumptions and estimates may have been made which may prove not to be accurate. Defender Capital undertakes no responsibility to correct any such inaccuracy. Subsequent changes in circumstances may occur at any time and may impact the accuracy of the information. To the full extent permitted by law, neither the Fund Manager, the trustee or any related entities makes any warranty as to the accuracy or completeness of the information in this newsletter and disclaims all liability that may arise due to any information contained in this newsletter being inaccurate, unreliable, or incomplete. Past performance is not a reliable indicator of future performance.