Defender

Global Fund

The investment objective is to generate superior returns for Unit Holders by investing in global markets, with a focus on reducing risk and preserving capital.

About Fund

The Fund provides investors with exposure to global markets through a long and short strategy. The investment strategy starts with the Manager’s global macroeconomic and market outlook, then overlays key thematics which the Manager believes will effect future performance and combine this with a bottom-up investment decision criteria.

(at 31 July 2024)

About the Fund Manager

The Manager (Defender Capital Pty Ltd) is a specialist investment manager and brings a strong record of accomplishment, a high conviction investment style and a benchmark independent philosophy to stock selection. As a firm majority owned by its principals, our client’s objectives are our objectives. The Manager’s investment products are designed to take advantage of the strengths and capabilities of our experienced investment team and also opportunities which we feel exist in the market place.

James Manning

Director and Responsible Manager

Leads the compliance and management efforts at Defender AM. With a strong foundation in finance and accounting, James holds qualifications in B.Bus (Accounting) and M.Bus (Finance). Additionally, he holds leadership positions in Vertua Limited and Mawson Infrastructure, demonstrating his multifaceted experience and capabilities.

Nick Hughes Jones

Director and Responsible Manager

Nick directs the investment management strategy for Defender Capital’s main funds and leads the formulation and execution of the investment process. Nick has over 15 years of financial markets experience and previously advised on over $500 million for family offices and high-net-worth individuals at Bell Potter Securities and Southern Cross Equities.

How we invest

The fund provides investors with exposure to global markets through a long and short strategy. The investment strategy starts with the Manager’s global macroeconomic and market outlook, then overlays key thematics which the manager believes will effect future performance and combines this with a bottom-up investment.

Portfolio

Weightings as at 15th May 2025

| Cash | 3% |

| Australian Equities | 3% |

| International Equities | 30% |

| Managed Funds | 16% |

| Private Companies | 18% |

| Alternative Investments | 29% |

Portfolio

As at 17 July 2024

| Cash | 3% |

| Australian Equities | 3% |

| International Equities | 30% |

| Managed Funds | 16% |

| Private Companies | 18% |

| Alternative Investments | 29% |

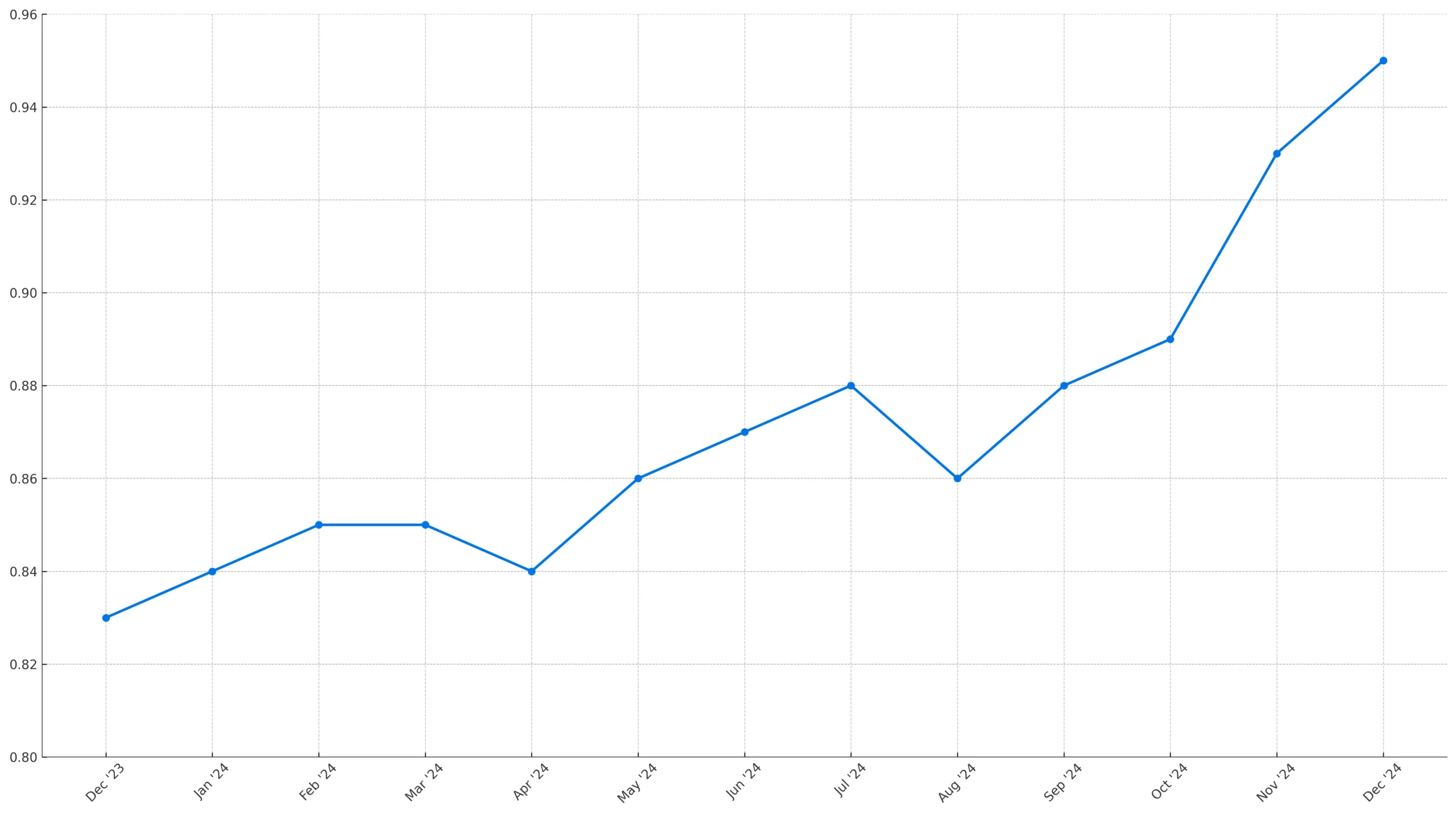

Fund Performance

As of 31 March 2025

Performance Summary

| 2025 | 2024 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mar | Feb | Jan | Dec | Nov | Oct | Sep | Aug | Jul | Jun | May | Apr | |

| Unit NAV | $0.91 |

$0.95 | $0.96 | $0.95 | $0.93 | $0.89 | $0.88 | $0.86 | $0.88 | $0.87 | $0.86 | $0.84 |

| 12 month Performance | ~+7% | |||||||||||

| Qtr Performance | -4.3% | |||||||||||

Past performance of the Fund is not a reliable indicator of future performance. No performance is forecast.

Latest News

Put Yourself in the Right Lane For Success.

Contact one of our Financial Professionals Today.

Explore Other Defender Funds

Discover more investment opportunities across our funds.

Targeting high-growth opportunities in the artificial intelligence sector.

Investments in media and communication businesses with scalable potential.

Investing in healthcare companies with growth potential.