The Defender Tourism Fund (Fund) is focussed on tourism and hospitality assets in Australia and reflects a strategic approach tailored to prevailing market dynamics and investor demand.

The fund’s portfolio includes properties such as Ballina Beach Resort, Tuross Beach, Stewarts Bay Lodge, Barclay Motor Inn, The Gateway Motel, Yamba Motor Inn, and Central Court Motel. Offers half-yearly income distributions with a consistent distribution history and steady growth exceeding 10% p.a.

Given the nature of the Fund, there are both internal and external management teams operating the business.

The internal management focus on operational day-to-day activities and are employed by the Fund. The external management is overseen by Defender Asset Management.

Darron Wolter

Chief Executive Officer

Darron began his career in the hospitality industry by managing Hotels in Sydney back in 1987. Having extensive experience in analysing business insights, Darron has developed and effectively implementing strategies to streamline and consolidate operations into an enterprise solution. Through leadership Darron has been able to inspire the behaviour and ethos of the management team to adopt best practices and enhance guest experience.

Ashlee Rogers

Operations Manager

Ashlee has vast experience in the hospitality and customer service industry with over 27 years of dedicated service across Australia, United Kingdom and the United States of America. Ashlee prides herself on strong communication and leadership skills which has added to her successful career in the many leadership roles she has undertaken.

We are focused on the acquisition of tourism and hospitality assets. The Fund seeks to acquire both passive investments as well as actively managed businesses. By improving systems and focusing on overall returns we add value to the business and underlying property

Acquire property and associated businesses with high value-add potential, ideally below replacement value.

Undertake a repositioning strategy to create additional value, increasing the income and capital value.

Integrate and improve operating procedures, through deployment of technology and processes to increase revenue, reduce costs and improve margins.

Position either single assets or the enlarged portfolio for an ultimate exit, designed to maximise the total return to investors.

Type of venue

Total rooms

Ownership

Type of venue

Total rooms

Ownership

Type of venue

Total rooms

Ownership

Type of venue

Total rooms

Ownership

Type of venue

Total rooms

Ownership

Type of venue

Total rooms

Ownership

Type of venue

Total rooms

Ownership

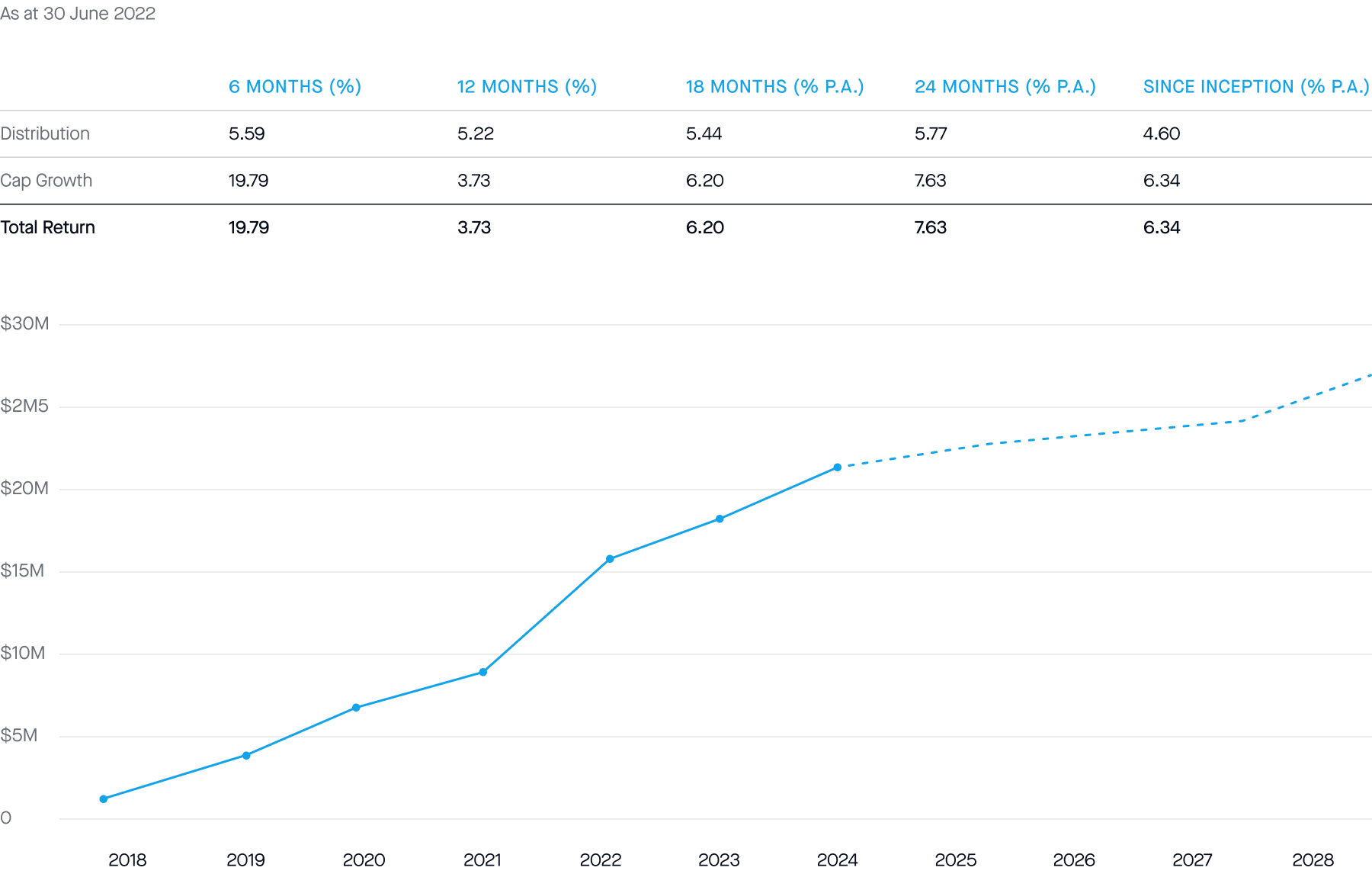

Past performance of the Fund is not a reliable indicator of future performance. No performance is forecast.

Contact one of our Financial Professionals Today.

Defender Asset Management Pty Ltd

(A.C.N 608 281 189; AFSL 482722)

Important Information

Nothing in this website should be construed as being personal financial advice. It is general nature only and has not taken into account your particular circumstances, objectives, financial situation or needs. You should consider whether the information, strategies and investments are appropriate and suitable for you or seek personal advice from a licensed financial planner before making an investment decision. An investment in the Fund is subject to investment risk. The target rate of annual return from investments retained in the Fund is not guaranteed and no assurance is given that the target rate will be achieved for any time the investment is held in the Fund. Distributions from the Fund to investors may be lower than targeted and may vary. Past performance of the Fund is not a reliable indicator of future performance. No performance is forecast.

Defender Global Fund

The Fund is a product of Defender Global Pty Ltd (A.C.N 647 387 684; corporate authorised Representative No. 001285565), corporate authorised representative of Defender Asset Management Pty Ltd (AFSL 482722). You should consider the relevant information memorandum of the Fund (IM), before deciding whether to invest, or to continue to invest, in the Fund. An investment in the Fund is subject to investment risks (as referred to in the IM), including the loss of capital invested. No assurance is given as to distributions or their rate when investments are withdrawn or repayment of moneys invested. Withdrawal rights are subject to liquidity and may be delayed or suspended (see the IM). Other significant features and risks are disclosed in the IM.

© Defender Asset Management Pty Ltd. 2024. All rights reserved.

Important Information

Nothing in this website should be construed as being personal financial advice. It is general nature only and has not taken into account your particular circumstances, objectives, financial situation or needs. You should consider whether the information, strategies and investments are appropriate and suitable for you or seek personal advice from a licensed financial planner before making an investment decision. An investment in the Fund is subject to investment risk. The target rate of annual return from investments retained in the Fund is not guaranteed and no assurance is given that the target rate will be achieved for any time the investment is held in the Fund. Distributions from the Fund to investors may be lower than targeted and may vary. Past performance of the Fund is not a reliable indicator of future performance. No performance is forecast.

Defender Global Fund

Important Information

Defender Asset Management Pty Ltd

(A.C.N 608 281 189; AFSL 482722)

Important Information

Nothing in this website should be construed as being personal financial advice. It is general nature only and has not taken into account your particular circumstances, objectives, financial situation or needs. You should consider whether the information, strategies and investments are appropriate and suitable for you or seek personal advice from a licensed financial planner before making an investment decision. An investment in the Fund is subject to investment risk. The target rate of annual return from investments retained in the Fund is not guaranteed and no assurance is given that the target rate will be achieved for any time the investment is held in the Fund. Distributions from the Fund to investors may be lower than targeted and may vary. Past performance of the Fund is not a reliable indicator of future performance. No performance is forecast.

Defender Global Fund

The Fund is a product of Defender Global Pty Ltd (A.C.N 647 387 684; corporate authorised Representative No. 001285565), corporate authorised representative of Defender Asset Management Pty Ltd (AFSL 482722). You should consider the relevant information memorandum of the Fund (IM), before deciding whether to invest, or to continue to invest, in the Fund. An investment in the Fund is subject to investment risks (as referred to in the IM), including the loss of capital invested. No assurance is given as to distributions or their rate when investments are withdrawn or repayment of moneys invested. Withdrawal rights are subject to liquidity and may be delayed or suspended (see the IM). Other significant features and risks are disclosed in the IM.

© Defender Asset Management Pty Ltd. 2024. All rights reserved.

Important Information

Nothing in this website should be construed as being personal financial advice. It is general nature only and has not taken into account your particular circumstances, objectives, financial situation or needs. You should consider whether the information, strategies and investments are appropriate and suitable for you or seek personal advice from a licensed financial planner before making an investment decision. An investment in the Fund is subject to investment risk. The target rate of annual return from investments retained in the Fund is not guaranteed and no assurance is given that the target rate will be achieved for any time the investment is held in the Fund. Distributions from the Fund to investors may be lower than targeted and may vary. Past performance of the Fund is not a reliable indicator of future performance. No performance is forecast.

Defender Global Fund

Important Information